How PIVOT is helping landlords upgrade rental properties while navigating tax relief and deductible expenses for rental income

Share

Some upgrades to residential property are purely cosmetic. Others go further, changing how a rental property is positioned in the market, how it performs financially, and how it is treated for tax purposes.

For many landlords, understanding how different types of expenditure are treated is central to managing rental income, rental profit, and overall tax liability. The way an upgrade is classified can influence what may be deducted from rental income in a given tax year, what form of tax relief may be available over time, and how costs are reflected when a property is eventually sold.

This article explores where PIVOT sits within that framework for landlords upgrading rental property, particularly where the intention is to enhance income potential rather than fund a personal lifestyle purchase.

When a rental property upgrade is treated as expenditure rather than a personal cost

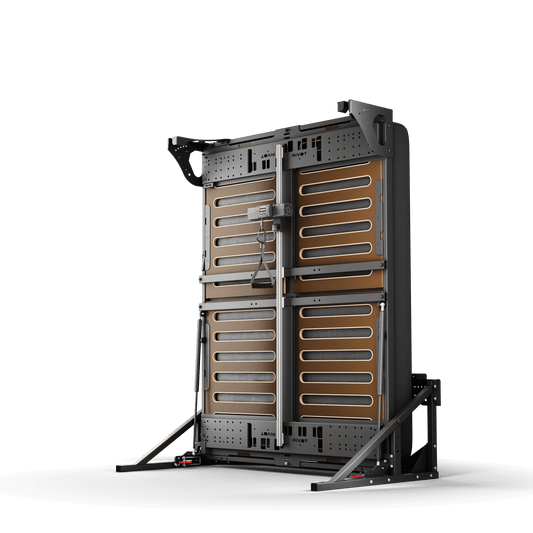

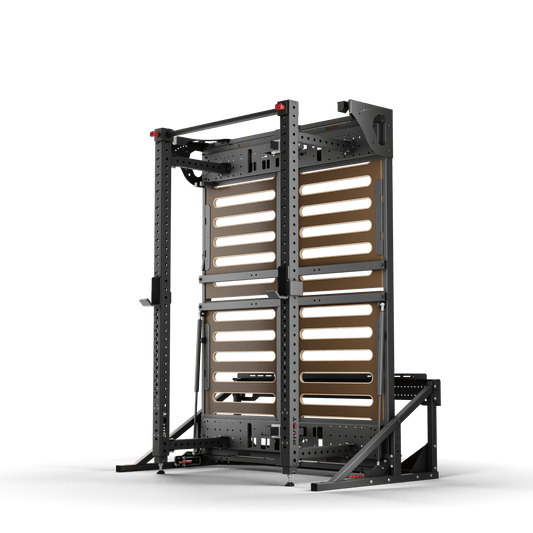

PIVOT is a premium bed that transforms into a fully integrated, commercial-grade gym. Installed in a residential property, it allows any property to be marketed as having a high-end, integrated home gym without structural alteration, without reducing sleeping capacity, and without permanently changing the fabric of the building.

From a landlord’s perspective, this type of upgrade represents expenditure incurred to enhance how a let property is used and marketed. It is designed to support rental income and improve rental profit by differentiating the property within a competitive market for residential property.

In practice, landlords who invest in distinctive, non-structural upgrades often find that their rental property attracts stronger demand, achieves higher rent, and performs more consistently across different market conditions.

Capital expenditure, allowable costs, and tax implications for rental income

Expenditure on rental property is not treated uniformly for tax purposes. Some costs are classified as capital expenditure, while others may be treated as allowable costs or deductible expenses over time, depending on how they are incurred, how the property is let and the country in which the property is located.

Capital expenditure typically relates to structural or permanent changes to a property and is usually considered when calculating capital gains tax if the property is sold. Other forms of expenditure, particularly on removable or non-structural items installed to support rental income, may be treated differently for tax purposes.

What matters is how the upgrade is classified, how it is used, and whether it is incurred wholly and exclusively to generate rental income from a rental property.

Allowable and deductible expenses in the context of rental property

When renting out a property, the tax system recognises that some costs are incurred specifically to support property income. These expenses incurred in connection with rental may be deducted from rental income, treated as an allowable expense, or relieved over time rather than resulting in immediate tax.

Landlords are already familiar with this logic in relation to domestic items relief, replacement domestic items relief, and the cost of replacing appliances or equipment provided for tenant use. In these situations, the expenditure is not treated as a personal cost, but as part of the overall cost of letting a property.

PIVOT sits closer to this category than to permanent capital improvements. It is a removable, non-structural asset installed to support rental income rather than a fixed enhancement to the building itself.

Rental income, rent, and the commercial impact beyond tax treatment

Tax relief, where available, does not replace the commercial rationale for a rental property upgrade. It supports it.

Landlords who improve the functionality and appeal of their rental property often find that these upgrades justify higher rent as their property listing drive more demand, attract more qualified tenants, and reduce void periods. Over time, this can increase rental profit and strengthen overall property income. And having a PIVOT in your listing will give it an edge over others and a strong unique selling point.

Where allowable expenses or deductions apply, they can reduce the amount of tax payable on taxable rental income, lowering the tax bill while the commercial upside of the upgrade remains intact.

Asking the right question about allowable costs and tax treatment

Rather than speculating, the most practical next step for any landlord is to speak with an accountant or adviser and ask a clear, focused question:

“If PIVOT is installed specifically to upgrade a let property and generate rental income, can the cost be treated as an allowable expense, deducted against rental income over time, or reflected in capital gains tax rather than treated as a personal expense?”

That single conversation will clarify the tax implications, the amount of tax payable, and how the expenditure should be treated in the relevant tax year and beyond.

A commercial upgrade for rental property, not a personal expense

For many landlords, upgrading rental property today is about more than appearance. It is about enhancing income potential, strengthening long-term returns, and managing tax implications responsibly.

PIVOT is not a loophole. It is an upgrade designed for residential property that is let to generate income, offering a way to improve rental performance while being considered carefully and conservatively within the framework of allowable and deductible expenditure.

If you are not the decision-maker but are influencing property decisions as a tenant or adviser, you are welcome to share this article with a landlord or agent who may be exploring similar upgrades.

A necessary clarification on tax advice and tax affairs

It is important to be clear that we do not provide tax advice, do not determine how expenditure should be classified, and do not influence how landlords complete their tax return or manage their tax affairs. We do not advise whether a cost is deductible, whether tax relief is available, or how any item should be treated for tax purposes.

How an upgrade is treated depends on individual circumstances, the nature of the rental property, and professional advice. Nothing in this article should be interpreted as confirming that any specific tax relief, allowable expense, or deduction applies to PIVOT or to any individual landlord.